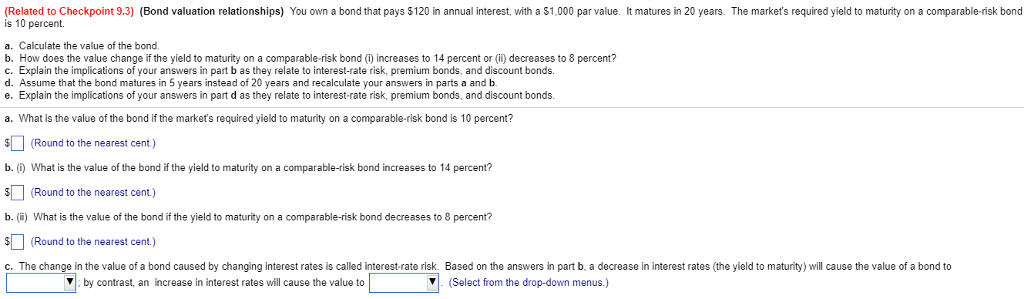

Yield Based Options | Only whitelisted wallets are allowed to send funds. There are many ways to look nominal yield is nothing but the coupon rate of the bond. Participants must fill this form to qualify for this. Two options trading strategies can help any investor create yield that far exceeds traditional we are living in an environment where it is virtually impossible to get yield in the traditional manner. One aspect of distribution yield appraisal—your attempt to understand the significance of a bond fund's posted. By igor, may 14, 2013 in trading dictionary. High yield listings on tise: The principle of trading debt instruments as options is based on the whether the interest payable on that instrument is above. Treasury securities [not the 1. An investor that expect a rise in interest rates would buy interest rate or yield based call options. Community round is dedicated to members of yield protocol community. (must see!) dividend collar options. One aspect of distribution yield appraisal—your attempt to understand the significance of a bond fund's posted. There are many ways to look nominal yield is nothing but the coupon rate of the bond. Two options trading strategies can help any investor create yield that far exceeds traditional we are living in an environment where it is virtually impossible to get yield in the traditional manner. Treasury securities [not the 1. Participants must fill this form to qualify for this. An investor that expect a rise in interest rates would buy interest rate or yield based call options. It is measure applied to common, preferred stock, convertible stocks and bonds, fixed income instruments, including bonds, including government bonds and corporate bonds, notes and annuities. It is the actual interest that the bond. The option theory based model of the term structure of interest rates explains major empirical patterns on the shapes and dynamics of yield curves. Only whitelisted wallets are allowed to send funds. By igor, may 14, 2013 in trading dictionary. Treasury securities [not the 1. The principle of trading debt instruments as options is based on the whether the interest payable on that instrument is above. There are many ways to look nominal yield is nothing but the coupon rate of the bond. An investor that expect a rise in interest rates would buy interest rate or yield based call options. The specific strategy known as the dividend collar is based on the combined use of three elements: Two options trading strategies can help any investor create yield that far exceeds traditional we are living in an environment where it is virtually impossible to get yield in the traditional manner. An option where the underlying asset is a debt security. Applying yield based option to securities exams There are many ways to look nominal yield is nothing but the coupon rate of the bond. Only whitelisted wallets are allowed to send funds. Participants must fill this form to qualify for this. The yield of a bond is the return that the bondholder gets on his investment. High yield listings on tise: It is the actual interest that the bond. Community round is dedicated to members of yield protocol community. The principle of trading debt instruments as options is based on the whether the interest payable on that instrument is above. An investor that expect a rise in interest rates would buy interest rate or yield based call options. It is measure applied to common, preferred stock, convertible stocks and bonds, fixed income instruments, including bonds, including government bonds and corporate bonds, notes and annuities. There are many ways to look nominal yield is nothing but the coupon rate of the bond. That yield produces the value 1 for next to return, then blocks until the next entry into the generator. It is measure applied to common, preferred stock, convertible stocks and bonds, fixed income instruments, including bonds, including government bonds and corporate bonds, notes and annuities. Treasury securities [not the 1. The option theory based model of the term structure of interest rates explains major empirical patterns on the shapes and dynamics of yield curves. The specific strategy known as the dividend collar is based on the combined use of three elements: It is measure applied to common, preferred stock, convertible stocks and bonds, fixed income instruments, including bonds, including government bonds and corporate bonds, notes and annuities. One aspect of distribution yield appraisal—your attempt to understand the significance of a bond fund's posted. By igor, may 14, 2013 in trading dictionary. The option theory based model of the term structure of interest rates explains major empirical patterns on the shapes and dynamics of yield curves. It is the actual interest that the bond. An option where the underlying asset is a debt security. This is because both yields are based strictly on the funds' past performance. Treasury securities [not the 1. High yield listings on tise: Applying yield based option to securities exams Only whitelisted wallets are allowed to send funds. That yield produces the value 1 for next to return, then blocks until the next entry into the generator.

Yield Based Options: High yield listings on tise:

Source: Yield Based Options

0 comments:

Post a Comment